Two phenomenal must-own growth stocks – one already in the portfolio but looking hotter than ever, one new

The chart above relates to Vuzix, a new addition to the QV for Shares portfolio but first, moving in alphabetical order, I am going to have another look at Upstart Holdings, a company which is already in the portfolio, has just released great figures and a stunning outlook statement, has just made an exciting acquisition and has ambitious plans to take the banking industry into the 21st century.

Upstart Holdings UPST. Buy @ $119. MV: $8.3bn Next figures: 2 June. Times recommended: 5. First recommended: $62.50 Last recommended: $74. Highest recommended: $78

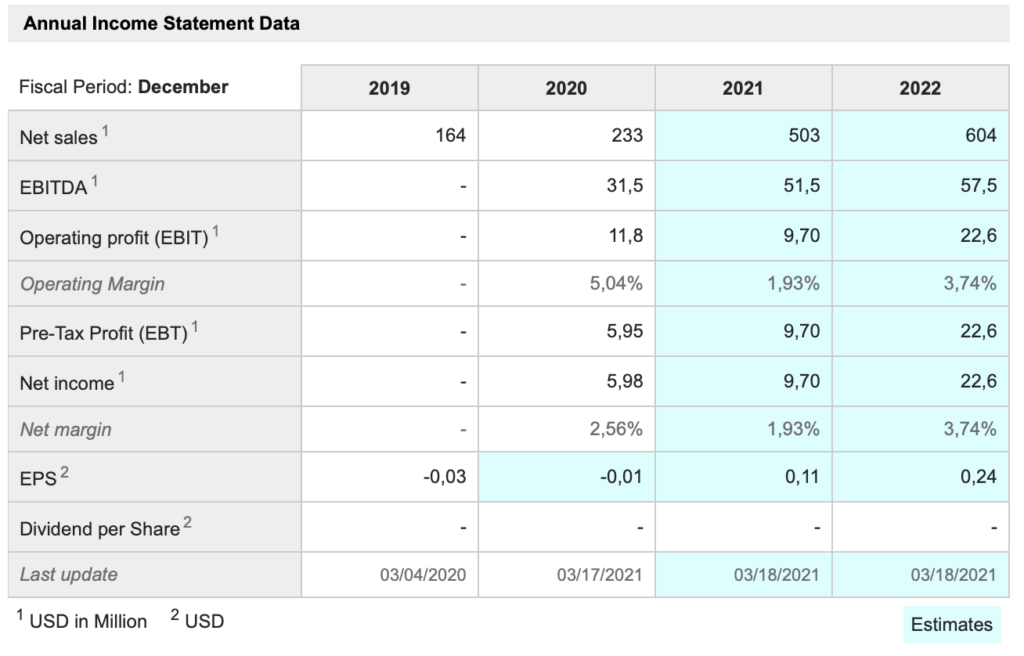

Upstart Holdings is a perfect example of the battle currently raging in the US stock market between incredible prospects and historically high valuations. Back in the day a company on a PE ratio of 20 (share price divided by earnings per share) was considered to be on a demanding valuation. Upstart is trading at 17 times sales (see table below) and is, at best, modestly profitable.

As a result the shares are super volatile. Dealings began in December 2020 at around $28 a share. The price raced up to a peak around $105, tumbled back to $42 and then almost doubled in a day after reporting exciting results and a high-potential acquisition.

The shares are presently giving a programmatic buy signal although this is in response to a huge move so hardly buying cheaply after a decline. Incidentally, an oddity about the table below is the sales forecast of $604m for calendar 2022. This does not square at all with the bullish tenor of the CEO’s statement. My guess and this is entirely based on sticking a wet finger in the air is that 2022 sales will be nearer $1bn.

If I am right the valuation by then would be more like eight times sales, which is not expensive. I also have a way of converting sales into potential profits. A company like Upstart with proprietary software has elements of a mini-monopoly. This means that as the business matures profit margins should reach 20pc or even higher. Meanwhile taxes will stay low until accumulated losses are used up.

This means $1bn of sales implies $200m of profits and a PE ratio (market value divided by earnings) of 40. I am sure that Upstart’s management will regard sales of even $1bn as way short of their ultimate target, which means they would be very cheap. I would expect a prospective PE ratio of at least 100 for a company growing as fast as Upstart and with such outstanding prospects.

So what exactly happened to help the shares almost double in one day!

First was the outlook statement. Upstart works with banks and financial institutions to help them make quicker and better lending decisions. Business suffered because of lockdown but even so Q4 sales were up 39pc to $86.7m. As lockdown eases Upstart expect to get back to the growth it should have had without lockdown.

“For the full year of 2021, we now expect revenue of approximately $500m, representing a growth rate of 114pc year over year; contribution margin of approximately 41pc; and an adjusted EBITDA margin of approximately 10pc.”

On the longer term future CEO and co-founder, Dave Girouard, noted that the company had 15 bank customers now but expected many more in the future.

“And 15 is a great number, 30, 40, 50 will be better. But at some point, it becomes commonplace that banks who are winning market share, who are doing well, who are serving their customers with their very best product are using somebody like Upstart to help them do it. And when it becomes commonplace, there’s certainly, I think, a moment of acceleration in the future where it’s really a mainstream technology that most banks use. It’s only a question of when that day comes.”

As well as the strong trading news the group announced the acquisition of Prodigy Software, a provider of automotive retail software. Girouard noted “Auto retail is among the largest buy-now-pay-later opportunities, and together with Prodigy, we aim to help dealers create a seamless and inclusive experience worthy of 2021.”

This looks like a huge opportunity. “In September 2020, the first AI-enabled auto loan was originated on Upstart’s platform. In this initial phase, Upstart is enabling consumers to refinance expensive and mispriced auto loans, saving borrowers an average of $72 per month. Following the initial launch, Upstart continues to roll this program out in states across the country. With the acquisition of Prodigy, Upstart will accelerate its efforts to offer AI-enabled auto loans through the tens of thousands of auto dealers nationwide where the majority of auto loans are originated. Prodigy is the first end-to-end sales software that bridges the gap between how dealerships operate and the new way that people are shopping for cars. More than $2bn in vehicle sales have been powered by Prodigy at franchised dealers from top brands such as Toyota, Honda, and Ford.”

We don’t have any other numbers relative to the deal and Upstart says they are still testing the water and developing the product so no material impact is expected in 2021. Longer term the opportunity looks huge.

“Each year, approximately $1 trillion of cars are sold in the US, and most of them are financed. Yet purchasing a car consistently ranks among the worst consumer experiences, with less than 1pc of buyers satisfied with the current process.”

A third exciting new initiative is helping Spanish speakers, a vast market in the US, to access loans more easily.

“The results of these tests say it all, Upstart’s platform offers significantly higher approval rates and lower interest rates to every demographic group tested. That is an outcome we believe every bank should strive for in its lending programs. While better AI models are the primary lever we use to create a more inclusive platform, it’s not the only lever. Very soon, we’ll release a Spanish language version of our product that we believe is the first of its kind among digital lending platforms in the U.S. While restaurants and retailers routinely offer a Spanish language alternative, online lenders, unfortunately, do not. Taking out a loan is a big decision, and it comes with important obligations. So it’s clearly better for the consumer if the entire experience, including disclosures, the loan agreement, and customer support are available in their preferred language.”

This quote says a great deal about online companies generally. They are built around offering the best service to customers and doing everything to achieve that goal. Many traditional companies may say all the right things in their ads but customers are treated as a nuisance, almost the enemy.

The last and maybe the most important point that Upstart makes is about how their business is using AI to improve their offering at an incredible rate.

As Girouard puts it. “There’s broad consensus that the credit economy is highly inefficient, if not broken. Models for quantifying risk and pricing loans are not far from a roll of the dice. Millions of consumers don’t have access to credit, pay too much for it or take on credit that they can’t ultimately afford. On the other hand, banks in 2021 are swimming in deposits and are looking for more sophisticated tools to lend them out in a responsible and profitable manner. There’s far less consensus that modern data science, namely artificial intelligence, can remedy the situation, but Upstart is validating this thesis every day. In a 2018 study, Upstart demonstrated to several large U.S. banks that our AI-based lending platform could almost triple their approval rates while holding losses constant compared to their current risk models. And that was in 2018. Upstart’s AI models have improved constantly and dramatically since then. This is an important point. One way to grasp the potential for AI lending and how different it is from traditional approaches is that we look back at our own models from just a few years ago and shake our heads at how simplistic and rudimentary they were compared to our current capabilities. As a public company, our financial results will ultimately speak to how unique and differentiated our AI models are.”

No wonder he concludes “In closing, I want to say that while we’re in the first stages of adoption of AI lending, we’re confident that this transformation will play out for years and decades to come.”

I think Upstart is a fabulous company just at the dawn of a sustained period of dramatic growth. It’s hardly surprising that after such a leap in price and given that the company IPO’d at $20 for a market value of $1.45bn as recently as last December that investors are taking profits. But to me the potential seems huge. I will be surprised and disappointed if Upstart does not become a $100bn company one day.

Vuzix. VUZI. Buy @ $28. MV: $1.69bn Next figures: 3 May New entry

Vuzix is also exciting, maybe up there with Upstart Holdings. The company makes smart glasses capable of delivering augmented reality. They are a little bit reminiscent of Google Glass, Sergey Brin’s pet project that never seemed to come to anything so at first I was sceptical but Vuzix really does seem to be on to something.

They are taking the world of healthcare by storm. Already over 20 knee operations have been performed using Vuzix’s smart glasses. Surgeons have to start sometime but by wearing smart glasses the relative novice can perform the operation while the old hand who has done hundreds of knee operations can watch and advise without having to be there.

This has obviously been helpful in a world disrupted by Covid-19 but it is also very efficient so there will be no return to old ways even if Covid ceases to be a problem.

Vuzix glasses are expensive, say $2500 a pair and offered to enterprises rather than consumers. So even if, as widely reported, Apple eventually comes out with a new wearable device in the form of smart glasses it is unlikely to complete with Vuzix, which is the market leader in the fledgling but explosively fast growing enterprise market.

Another sector showing great interest is the military. Vuzix CEO, Paul Travers refers to this but says although he has high hopes of important business it is still going through the bureaucracy. If they do bite and it seems odds-on that they will the orders should be big.

The field is incredibly exciting. Here is what one analyst said recently.

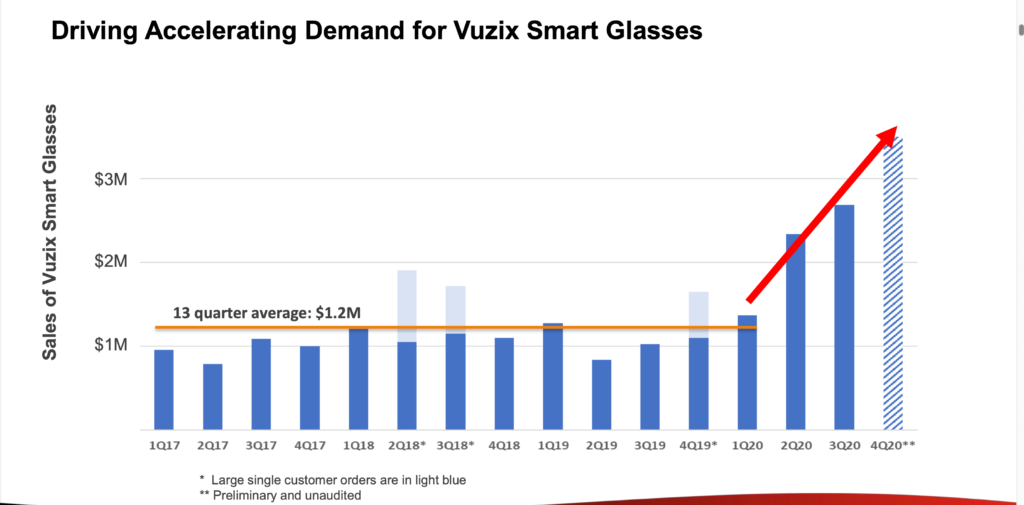

“The increase in Smart Glasses demand really began in the spring of 2020 and has only strengthened further into the end of 2020. Smart Glasses demand has been broad-based for Vuzix and is not attributable to just one or two large accounts. Vuzix has already released preliminary unaudited numbers for Q4 showing that overall Q4 2020 revenue increased more than 100pc year-over-year to over $4.0m, versus $1.96m for the fourth quarter of 2019. That number well exceeded the Q4 consensus analyst revenue estimate of $3.5m. Vuzix is entering one of the strongest and most promising periods in their history in terms of smart glasses demand, product line strength, OEM developments and the significant advancements being made on next-generation technology.”

My impression is that we are at a tipping point and that Vuzix is being almost overwhelmed by demand with big new customers and orders coming almost ever day.

As almost always with exciting shares I am never the first to find them. Vuzix shares have exploded higher in the last 12 months. In March 2020, when Covid struck in earnest, the shares fell below $1 and many investors would think it is too late to buy. But for the right shares it is never too late. I always look forwards rather than backwards and I think this business is just getting started.

The products are amazing and there are dramatic improvements coming along all the time. The steep rise in the share price also meant that outstanding warrants were triggered bringing much needed cash into the business, which has not only just had the best quarter in its history but also has its strongest ever balance sheet.

Analysts are forecasting sales reaching $17.2m for 2021, an increase of 85pc over 2020. Typically at tipping points such as we now have the analysts drop behind the curve. I would not be surprised to see Vuzix beat those forecasts, maybe by a substantial margin. This business is on fire.

Listen to this from an analyst who follows the business. “Augmented reality (“AR”) technology is still at a relatively early stage and is expected to be a huge megatrend during this decade. At the same time, Vuzix is known as one of the most innovative companies within the field of AR and has won numerous Consumer Electronics Show (or CES) awards. Vuzix is one of the few pure plays that can be invested in to take advantage of this AR megatrend and this attracts investors and analysts that have a venture capital mindset.”

You get the sense of how fast this business is moving by looking at press releases issued just in March.

1 March – Vuzix M400 and M4000 smart glasses now support Microsoft Teams.

2 March – Vuzix announces strategic investment in supply chain and order fulfilment software provider, Ox Fulfilment Solutions.

9 March – Rio Tinto improves worker safety and supports local operations at its Oyu Tolgoi mine using Vuzix Smart Glasses

10 March – Vuzix partners with rooom AG to expand its presence in enterprise training and education around 3D augmented reality content.

15 March – Vuzix reports record Q4 and full year smart glasses revenues

17 March – Vuzix receives initial smart glasses deployment order from major US insurance services company.

18 March – CooperVision deploys Vuzix M400 Smart Glasses at its Upstate New York distribution centre.

Like all 21st century devices businesses, Vuzix uses a mixture of hardware and software to achieve its goals. This involves a great deal of innovation.

“Vuzix is one of the more innovative companies involved in making wearables like Smart Glasses. Vuzix has developed a lot of critical IP in very key areas of AR Smart glasses technology like waveguides, small projection engines, holograms, and MicroLED displays. Vuzix currently has 184 patents and patents pending versus 90 only three years ago.”

It also offers the opportunity to reposition the business around recurring SaaS subscription revenues from selling software upgrades so the customer always has the latest version.

“It is important to note that most of these connector applications currently generate recurring revenue for Vuzix. We also resell several of our partner applications, which again generate recurring revenues. I would like to add, Vuzix is starting to place a focus on vertical software applications around our smart glasses in markets that are not currently being addressed. These applications will be built on a SaaS-based business model that should make our smart glasses even more sticky for our customers and result in recurring revenue streams for Vuzix.

We expect that for every hardware sale that includes one of our vertical SaaS solutions, we would see an even more significant recurring revenue stream from the application itself. We’ll be sharing more as we bring these solutions to market. OEM [original equipment manufacturer] and related engineering services business gained further momentum in 2020 as we expanded in terms of the number of engaged customers, as well as their progression toward eventual volume production programs with them. The multiyear revenue potential associated with volume production for these programs related to aerospace and defense, healthcare, and Waveguide-based display engines remains a significant opportunity for Vuzix.”

On all fronts there is so much going on at Vuzix.

“Looking forward to 2021, we intend to at least double our levels of investing activities for our 2021 fiscal year as compared to the actuals in 2020, primarily focused on new product development and IP, as well as increased R&D spending, by at least 50pc over 2020 levels. Further, we intend to incur additional spending on sales and marketing activities, particularly overseas, where we see many opportunities. Vuzix now has the capital resources to smartly invest and grow with future business, and with the expected planned revenue growth in 2021 and beyond, we do not see substantial risk in investing more for such growth while expanding our IP and competitive position.”

Last but not least is the chart, which looks spectacular.

Share prices are still being pressured by rising US bond yields and unwinding of margin positions. The underlying performance of companies though looks as impressive as ever as witnessed by the results being delivered by the companies featured above.

Technology is advancing at an accelerating rate; China is enjoying an explosion of affluence, which is driving a flood of spending power across the world by people who, 30 years ago, had nothing more exciting in their lives than subsistence farming; and the world is slowly emerging from widespread lockdowns, which is expected to unleash a flood of consumer and investment spending.

Any weakness in stock markets is likely to be a short-term phenomenon. The long-term trend is surely going to be onwards and upwards. I have never seen so many exciting companies in which to invest. So much is this the case that I suspect the sharp rise in margin funding in recent months may be a sustainable phenomenon as growing numbers of individuals world wide become first time investors in shares and ETFs.

There is another revolution happening as technology empowers individuals to take responsibility for their own finances from banks and institutions, which have not exactly covered themselves in glory in recent decades.