Upstart Holdings UPST. Buy @ $192. MV: $15bn. Next figures: 10 November. Times recommended: 11. First recommended: $62.50. Last recommended: $179.85

Upstart CEO and co-founder, Dave Girouard, has huge ambitions for his business. This is what he said in his closing remarks ending the latest quarterly report.

“We think we have an opportunity to build one of the top handful of fintechs in the world because we are in a very, very large space, and because we think AI really is the future. It’s the most transformational change that’s happened in that space. So that’s why we’re excited.”

Investors are so used to the gung-ho optimism of American CEOs that they may take this as just another example of the genre but it really is something special. Paypal and Square are two of the largest fintechs in the world and they are capitalised at $327bn and $121bn respectively v $15bn for Upstart. If Upstart is going to join that club its value is going to appreciate dramatically.

And I suspect that privately Girouard thinks Upstart could become even bigger because it is operating in a different and potentially more scalable space. Paypal and Square are rivals to the banks whereas Upstart works with them.

Just a quick recap. Upstart’s co-founders are three very clever people. Two of them came from Google, where Girouard was the president of Google Enterprise and the third, Paul Gu, who was only 20 when he co-founded Upstart so you can imagine how highly Girouard must think of him, was a Peter Thiel fellow which is a striking accolade.

They realised that personal lending in America and worldwide was a broken system which failed to take advantage of the dramatic advances made in technology over the last 30 years and especially since the rise of cloud computing, artificial intelligence and the data economy. Lending decisions in America are based on rules from which they derive a score known after its originators at Fair Isaac as the FICO score.

The problem is that this score is very arbitrary and falls way short of optimising decisions on who banks should lend to, how much they should lend and at what rate. Most Americans don’t default on loans but pay rates set to make up for those who do. Many Americans who would repay cannot get loans. (Don’t I know it. I have never defaulted on a loan but because of my age I have been unable to borrow money, even for highly eligible projects, for over 15 years. This is one of the reasons why I hate banks. They really are useless and a major headwind stopping the economy from thriving). Others who shouldn’t can.

Upstart set out to use the latest technology and most specifically machine learning (ML) and artificial intelligence (AI) to change this. Instead of the handful of variables used to make a FICO loans they use over a 1,000 variables. Not only that but as I learned from an informative interview with Paul Gu, which I watched on You Tube where even the interviewer was a bit dazed by how clever his subject was, the AI also uses the relationships between the variables to perform incredibly complex assessments of creditworthiness and likelihood of default.

Last but not least the algorithms are improving all the time. Girouard says their ability to assess creditworthiness is massively better, like more than 10-fold what it was just a handful of years ago and improving, probably at an accelerating rate as they make more loans and feed more data into the system.

So far they have applied their technology to personal loans which are unsecured so perfect for their approach and are just starting to apply it to auto loans, a six times bigger market where they say there are also massive inefficiencies. All forms of lending to individuals and small businesses are subject to similar inefficiencies.

This probably explains why big companies don’t borrow from banks any more. They go directly to the market, issuing bonds and borrowing at incredibly low rates. They only way for individuals to get even remotely comparable deals is to use their homes as security and borrow a percentage on a conservative valuation. Banks are obsessed with assets as security for their loans because they know they are not very good at evaluating individual creditworthiness. All they really try to do is avoid obvious bad risks like people who have defaulted before.

Part of what Upstart does is use technology to rectify this problem. They use their technology to decide which individuals are most likely to repay based on their history and a whole raft of other characteristics. As they and their banking partners make more loans they feed the data back into the system and the software becomes ever cleverer at predicting risk, which feeds a constantly improving system.

It remains me of Google Search which was really clunky 20 years ago but amazing now because of this process of constant improvement (which is still happening).

If we call the above the theory behind what Upstart is doing then one analyst has described the latest set of quarterly results as proof of concept. In the quarter to 30 June 2020 loan demand temporarily collapsed, which caused revenues at Upstart, which are a function of loans made using the platform, to also fall sharply. Since they they have been recovering strongly to the point where the finance director said the latest results night be somewhat misleading with revenue gains over a year earlier above 1,000 per cent.

One analyst at the Upstart Q2 earnings conference described the results as the most amazing he had ever seen. “Yeah. But I’m guessing that none of — I’m not aware of any of your other competitors in the fintech world, which I would imagine have the same sort of strength in being fully online businesses and the like, that the pandemic helped. I don’t think they’re growing at five times over Q2 2019. I haven’t heard of anyone in the space growing at that kind of rate.”

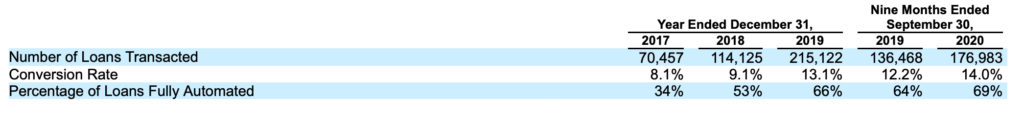

One statistic that stands out for me is that in June 2021 alone over 100,000 borrowers used the platform to secure a loan. Below you can see the historic figures for loans originated. These show that in just one month the group has made almost as many loans as it made in the whole of 2018 and more than half the number of loans made in the first nine months of 2020.

What is clear is that the customers love what Upstart is doing which is why their numbers are growing, albeit from a very low base. Also significant in the quarter was that one bank decided to stop using the FICO score as a hurdle which would-be borrowers must cross in order to qualify for a loan. In effect they were saying that they now had complete faith in the Upstart system to make lending decisions. A second bank is expected to follow suit shortly.

This is important because unlike Upstart, which is a pure technology company, which makes 97pc of its money from fees, when banks lend they do have their money on the line so they are very careful about doing it. Banks are simultaneously wonderful businesses which make a turn by borrowing from one set of customers and lending at higher rates to another but also vulnerable because their outstanding loans are a multiple of their equity base. This is why in a crisis banks go bust in droves. They cannot cope with massive defaults.

This brings us back to proof of concept and why it could lead to a tipping point for Upstart. Girouard believes that ultimately all personal lending and maybe even all lending decisions will be based on AI, which Bezos has described as the most exciting development in technology of our lifetimes. AI leads to better decision making so it looks like a no-brainer to use it once it is available. If that is correct at some point there is going to be a stampede of banks wanting to adopt it, which could be an incredible Zoom Video type moment for Upstart.

In relation to this Paul Gu made some interesting points in the interview I watched. If AI is so great for lending why is it only just now starting to happen. He said that it was because computing power had only reached the point were it could process the massive amounts of data involved in the last decade. He also said that one of the things he found most surprising was that nobody else had tried to do it leaving Upstart free to build a 10 year start.

Another threat is that if it is so great the banks will start doing it for themselves. Some may, he agreed, but it is not easy, especially for people coming from a risk averse rules based banking background. Very large banks may have the resources but they will have no incentive to share their technology with rival banks. Smaller banks will not have the resources and will be unable to collect the vast amounts of data needed to feed the system and help it ‘learn’.

For them it will almost certainly making more sense to outsource this skill to a third party business, which specialises in this area and where the culture is all about technology. Upstart aims to be this company, which explain why it sees such a massive opportunity.

Technology companies are ultimately groups of people so the quality of those people is all-important. Upstart has taken the decision, spurred on by Covid-19, to be digital first in its employment policies. This is already having a huge impact because if its people can work from anywhere the available talent pool increases exponentially. This is what Girouard said about this new initiative.

“Given the scale of our ambitions and the talent we need to aggressively pursue our goals, we need to tap into talent across the entire country. The good news is Digital First has paid immediate dividends to our recruiting efforts. Though we announced this plan just a couple of months ago, over a third of our job offers in the past few weeks have been to candidates outside our footprint. And we’ve seen an acceptance rate of 80pc to these offers, a dramatic improvement over what we’ve seen historically. Digital-first is not just a reaction to the last year and a half. It’s a sign that we intend to create one of the largest and most impactful fintechs in the world.”

There are many other more specific actions that Upstart is taking to further its ambitions. They have created a Spanish language version of their platform so that would-be borrowers whose first language is Spanish (a huge number in America) can negotiate applying for a loan more easily. This proved harder to do than expected in a highly regulated environment but is finally being rolled out.

They are making a big push to address the auto loan market. This is different because auto loans are secured by an asset but Upstart would still say its makes sense to focus on the borrower because that is the main determinant of likely defaults rather than the quality of the asset. They already have banking partners and have made 2,000 auto loans. These loans are typically to refinance existing loans on better terms.

They have also made an acquisition to help them access the customer at the dealer where he buys the car and typically uses finance to do it in what Upstart says is a $1 trillion market. The company they bought, Prodigy Software, is intended to help customers with the car buying experience using the latest technology. Finance is a big part of that which explains the synergy between the two businesses.

Upstart is planning major investment in Prodigy but is already seeing rapid progress. “Since the beginning of the year, we have doubled the number of dealerships, aka rooftops, using Prodigy. And in Q2, more than $1bn in vehicles were sold through Prodigy. We expect the first Upstart-powered loan to be offered through this platform before the end of 2021.”

A third thing happening at Upstart is that they are building an impressive war chest. In December 2020, in its IPO, the group raised $167m at $21 a share. In April 2021 the group raised a further $230m at $120 a share. It is now proposing to raise a further $575m in a convertible issue with the shares trading around $200 a share. Remember that Upstart regards itself as a pure technology company, not a bank so it doesn’t need these funds for lending or buying physical assets, especially as it embraces a work from home environment. It obviously has some ambitious plans, which will no doubt become clearer over coming months.

Remember also the battle for territory. Upstart is on the cusp of a first mover advantage, winner takes all moment in its history. It has the opportunity to be to credit markets what Google is to search. They are addressing credit markets where trillions of dollars are borrowed and lent and they believe all these decisions can be improved by using AI platforms which they have a 10 year head start in developing.

Investment is about possibilities not certainties. I don’t know what is going to happen to Upstart but I agree with the CEO. They could become a very large company indeed. Not least because of the powerful virtuous circle in which they already find themselves. The more loans they make the more data they collect and the better their algorithms become in evaluating credit risk. This enables its parent banks to offer loans to more people at better rates generating even more data to fuel the machine.

Last but not least is the possibility of a tipping point. As more banks use the platform successfully the pressure on rivals to follow suit increases. The whole thing could go ballistic. Upstart may even feel it needs a strong balance sheet not just for investment but to be a credible partner if its business continues to scale at the dramatic rate seen in recent quarters.

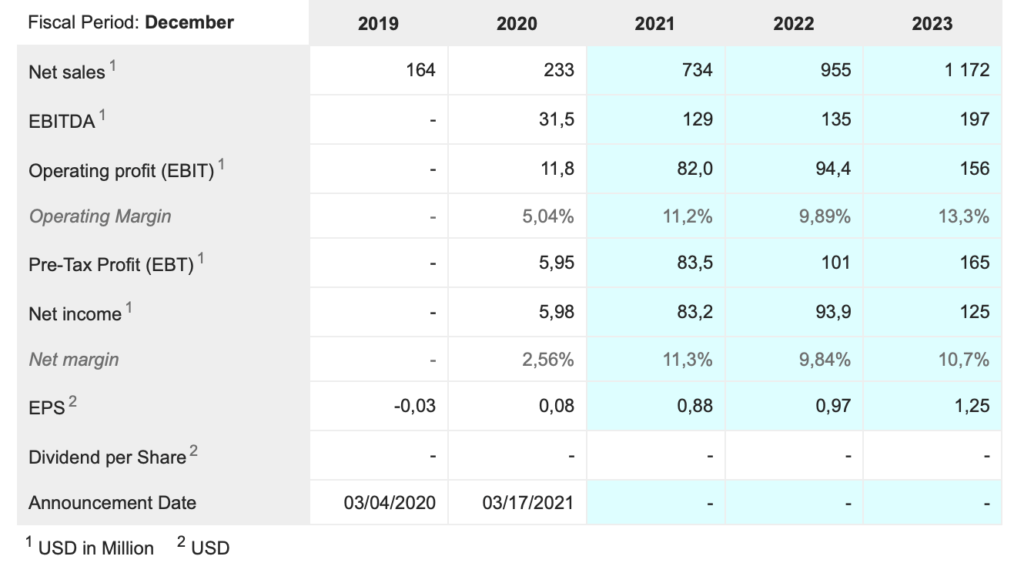

The growth really does feel like a runaway train. Total revenue in 2020 was $233m. At first analysts were looking for growth to something like $300m for 2021. Then they upped the number to $500m. It soon became obvious that figure was too low so they upped it again to $600m. The latest guidance from the company is for 2021 revenues of approximately $750m and we still have two more quarters to be reported.

Not only is this incredible growth but it also makes you wonder how meaningful are the expectations in the table below for 2022 and 2023, especially given that there should be an impact in those years from the new auto loans vertical.

You will not be surprised to learn that I view Upstart Holdings as a company and a share with incredible potential.

I should also mention that unlike many fledgling technology businesses, Upstart is already profitable.

Upstart is a bit like Tesla. Investors are not sure are if they are the real deal or somehow too good to be true. I am a believer. They seem to have all the credentials of a hyper growth stock including a super-impressive management team, a great story, an explosive chart and the fact that they are already delivering exponential growth. This is the simplest variable of them all. If a company is going to become very large it needs to grow very fast and sustain that growth for a good number of years, ideally at least a couple of decades if not more.

The management team at Upstart believe they are just starting as a company and they make an impressive case. CEO, Dave Girouard, says with his latest report that he believes his business is “worthy of your attention”. I second that sentiment. Upstart is definitely worth a look. My impression is that these shares are so hot they are smoking!