There are two possibilities. Shares are building a base which will form the springboard for the next bull market or they are consolidating before making a new downward leg. If the latter that would make this the most shattering bear market for technology shares since the bursting of the Internet/ millennium bubble in 2000.

I don’t believe such a collapse would be remotely justified by what is happening in the world. Technology ompanies, in general, are still doing well, are positive on prospects and have strong balance sheets and cash flows. It would take some kind of Armageddon to make shares fall sharply from here and absent a completely out of blind side Black Swan event I don’t see that happening.

I think the message I am getting from Coppock is correct, many shares, indices and ETFs are in the buy zone but we are not off to the races yet; hence my metaphor of the earthquake and the aftershocks. There are still sellers out there and the buyers are cautious.

Most threatening is the possibility that we have not reached the end of the rising interest rates cycle. There is still a scary gap between the inflation numbers being reported, close to 10pc or even higher, and the level of short and long term interest rates which are around or below four per cent.

There is also an amazing amount of momentum in the economy with labour shortages and incredible demand for luxury goods which are flying off the shelves. I am rather baffled by what is going on but I think I am not alone. The message from the world’s central bankers seems to change almost weekly.

We need Adam Smith’s invisible hand

A question is whether you can deal with shortages by crushing the economy. I am not sure you can. What the world needs is an increase in supply and I think that is what we are going to get. When I arrived at Worcester College, Oxford to study PPE, so long ago that it seems like another era, my very first economics tutorial was about supply and demand curves. If demand exceeds supply prices need to rise to dampen demand and stimulate supply; that is surely what is happening now and is the main thing that will get us out of this mess, not the politicians nor the bankers. They don’t have any magic wands.

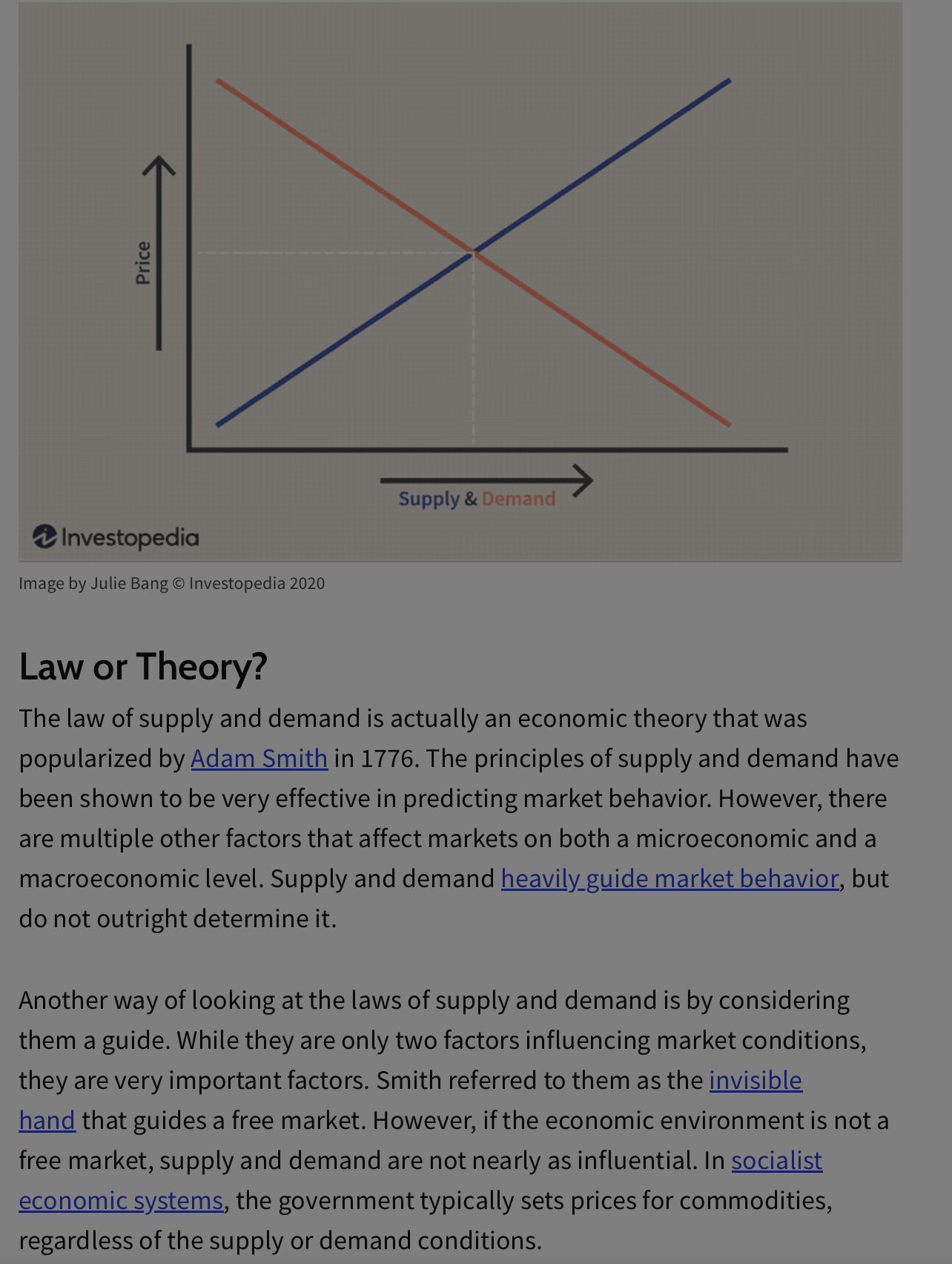

You can portray this in the form of a graph. The blue line is supply and the orange line is demand and it is much more important than anything Rishi Sunk is going to do.This is why I was stunned when Theresa May moved to cap utility prices. Did she know anything about Adam Smith and if she didn’t what kind of Conservative prime minister was she supposed to be.

This is also why it is ridiculous for ministers and unions to set pay for nurses, for example. The right price for nurses is not some sentimental figure that people think these caring angels of mercy ought to be paid but the price which enables hospitals to recruit as many nurses as they need. It is a job most people can be trained to do so it is never going to be very highly paid; that is an inescapable fact of life. It is all explained by the supply and demand curve.

This graph tells you straight away why Communism has proved such a disaster and why socialism doesn’t work unless your objective is equality at all costs which is why Stalin and Robespierre ended up killing all the rich people and even modestly well off people in the case of Stalin. The rewards of hard work and initiative in a capitalist economy are, or should be that you are successful. In a Communist economy you get shot. It is astonishing that anyone can imagine that such a system is a good idea.

Adam Smith’s great perception, which should be engraved on the hearts of every single Conservative MP, is that in the course of pursuing success for themselves, thanks to the invisible hand, people make their fellows better off. It is a miracle that should be cherished, not derided.

The simple reason why America does so much better economically than other countries is that people there, either consciously or unconsciously, believe more strongly in Adam Smith and his invisible hand. They admire success; they don’t want to tax it out of existence. They also realise that transferring industries into public ownership is not a recipe for improved performance and, if you think about it for more than 10 seconds, why should it be. Why should politicians or bureaucrats know how to allocate capital for the best results. The ONLY way to do this effectively is via capitalism, which is not so much an ‘ism’ as a definition.

This is why in my list of benchmarks there are so few UK and European shares. We just don’t seem to get it and have a belief in our political leaders which is proved to be unwarranted again and again.. The only good news is that, unlike an earlier Labour politician, Harold Wilson, who amazingly also studied PPE, the bastards have not yet stopped us buying American shares although they are doing their best to stop us buying American ETFs.