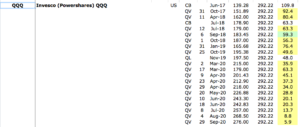

I launched Quentinvest for ETFs in the summer of 2017 and at first the performance was lacklustre. Like all shares ETFs go up and down and it can sometimes seem that it takes them a while to get going. They need the passage of time to show their worth but boy do they get there in the end. As with shares in QV for Shares I recommend the same ETFs time and again. I do this when they are going up to build exposure to strong performers. I also recommend favoured ETFs when the whole stock market takes a dive because they always recover. Just look at the chart of QQQ above. QQQ is an ETF which broadly tracks the performance of the Nasdaq 100 index. It is not a secret. On the contrary it is one of the most actively traded and widely held ETFs in the world with assets under management of $138bn. But it can still deliver astonishing results.

The table shows all the recommendations in QV for QQQ. They are the ones shaded in yellow and most of the gains are in high double figures. It seems like an obvious strategy to keep buying shares in an ETF tracking the Nasdaq 100, one of the world’s best performing indices for decades and an excellent proxy for the technology revolution but doing the obvious has still proved highly rewarding.

As I have frequently noted ETFs don’t go bust so buying into weakness usually works and they are continually rebalanced around the best performing shares so have a bias to reaching new peaks, especially if the best performers are really good performers as is proving the case with an army of exciting mostly US based technology companies.

Even I have been surprised by just how well behaved ETFs are as investments. I have just done a study of all the recommendations made in Quentinvest for ETFs since launch. I have treated each alert as a separate recommendation even when a previously recommended ETF is being alerted again. Note that there never have been and never will be any sell recommendations in QV for ETFs.

The results are very encouraging. Out of 271 alerts, 261 are showing gains. Only 10 alerts are currently negative. The odds on picking a winner when buying into a QV Alert are overwhelmingly positive. Out of the 10 negative alerts only three are significantly down and two of those are for the same ETF. The ETFs in question are both leveraged, FAS, Dierexion Daily Financial Bull 3x and 2MCL, Wisdomtree FTSE 250 2x. FAS is down on the first recommendation but helped by two subsequent alerts at much lower levels is well into profit. 2MCL is still down over all despite being up 38pc on the latest alert but I am alerting both of these again (see below). The other negatives are typically for ETFs that have been recommended so recently they are still modestly negative.

The overall gain on all recommended ETFs (every single alert since the summer of 2017) is 35.2pc. Since mid-2017 the FTSE 100 has traded mostly in a range around 7,400 but is currently 6337 so down almost 15pc on its median level for the period. Put these two statistics together and the gain for an investor following my ETF alerts rather than investing in the FTSE 100 is around 50pc better performance.

In theory this could change. The UK economy could explode into life and UK companies could take over leadership of the technology revolution from the Americans. Sadly I fear this is up there with if pigs could fly but if it did happen I would see it and adapt my recommendations accordingly. Meanwhile my main expectation is that the future will bring more of the same and the ETFs that have performed so well to date will continue to perform accordingly. There is a list below of 44 ETFs which I think are timely to buy right now. If I am wrong and shares take a dive I am sure they will still come good in the end. I have put in the table the code, the name of the ETF, which is a good indicator of what they do and the recommendation price.

They are all about technology, healthcare, finance, automation, robotics, artificial intelligence, the Internet of Things, millennials, social media, semiconductors and the growth in the Chinese economy and its fast emerging affluent middle class. These are all big trends that are going to be unfolding over years and decades, involving the energy and dynamism of new generations of ambitious and talented men and women. It is obvious that the businesses underpinning these ETFs are going to do well , which gives me the confidence to make such sweeping recommendations.

ARKQ @ $63.63 Autonomous Technology & Robotics

CHIQ @ $34 Global X China Consumer Discretionary

2MCL @ 19730p Wisdomtree FTSE 250 2x daily leveraged

3USL @ $877 Wisdomtree S&P 500 3x daily leveraged

CWEB @ $61 Direxion China Internet 2x daily leveraged

FAS @ $50 Direxion Daily Financial Bull 3x daily leveraged

SOXL @ $364 Direxion Semiconductor 3x daily leveraged

DIA @ $297 Dow Jones Industrials

FNY @ $58 First Trust Alphadex MidCap Growth

FXH @ $102 First Trust Alphadex Health Care

FNX @ $76.86 First Trust Mid Cap Core Alphadex

SHE @ $83 SPDR Series Trust Gender Diversity

EBIZ @ $29 Global E-commerce

FINX @ $40.6 Global X FDS Fintech

SNSR @ $26 Global X Internet of Things

GURU @ $41.50 Global X Hedge Fund Top Equity Holdings

MILN @ $33.85 Millennials Thematic

BOTZ @ $31 Global X Robotics & Artificial Intelligence

SOCl @ $54 Global X Social Media

FBS @ $40.70 Invesco Dynamic Media

PDP @ $81 Invesco DWA Momentum (100 large and midcap US names with strong relative performance)

RBOT @ $10.75 iShares Automation & Robotics

MIDD @ 1849p iShares FTSE 250

IWV @ $212 iShares Russell 3000

IUSA @ $30 iShares S&P 500

IHF @ $227 iShares Health Care Providers

IHI @ $317 iShares US Medical Devices

JSML @ $55 Janus Detroit Small Cap Growth Alpha

IPAY @ $58.50 Managers Trust Prime Mobile Payments

JFJ @ 680p JP Morgan Japanese Investment Trust

KWEB @ $75 KraneShares China Internet

MTE @ 1460p Montanero European Smaller Companies Trust

PTH @ $147 Invesco Health Care Momentum

PSI @ $94 Invesco Dynamic Semiconductors

SOXX @ $345 iShares Philadelphia Exchange Semiconductors

MFMS @ $36 RBB Fund MFAM Small Cap Growth

XSMO @ $43.77 Invesco Small Cap Momentum

PSCH @ $147 Invesco Small Cap Health Care

XHE @ $104 SPDR Health Care Equipment

XHS @ $88.50 SPDR Health Care Services

SLYG @ $68.50 SPDR Small Cap Growth

XSW @ $130.50 SPDR S&P Computer Software

SMH @ $198 Vaneck Vectors Semiconductor

VTWG @ $183 Vanguard Russell 2000 Growth

I have added the names of the ETFs as well as the codes, which are all you need for dealing purposes, because the names explain what the ETFs are about and why they are likely to make interesting investments. What is not always obvious is that there is a common theme of innovation across almost all these ETFs, whether the focus in on healthcare, payments or technology. There are quite a number of healthcare focused ETFs partly because of demand create by the virus but also because healthcare is a field where huge amounts of money are being invested in research both to improve outcomes and also to help ageing populations and deal with the growing burden of trying to provide universal healthcare. Another theme is smaller capitalisation companies. In recent years indices have been dominated by the performance of the tech giants, the trillion dollar businesses but it seems that the time has come for smaller companies to do better. There could be two reasons for this. On is that smaller businesses suffered more from the virus and have more to gain from a return to normality. The other is digital transformation, which is both imperative for all, especially during lockdowns, when online sales were often the only sales available but also because a growing range of business to business companies are making digital transformation available even to small businesses and once you have transformed this creates great opportunities.

Some of the ETFs are leveraged. Never forget that these ETFs will be volatile but they can also be rewarding if (a) you can stand the volatility and (b) you pick up some shares after sell-offs as they start to recover. This is something I have been doing for the ETFs in the table and is another reason why the performance has been so good. I haven’t featured it this time but QQQ3, a London quoted, US$-priced ETF, which offers three times daily leverage of the QQQ ETF, is currently the best performing ETF in my table. This would not have been the case in March , when coronavirus funk hammered the indices and QQQ3 plummeted from $86 to $23 in two months. This was both terrifying and an incredible buying opportunity and I actually recommended the shares in QV for ETFs on the day the market hit bottom. The price is presently over $100 after a 30 for 1 share split.

The general rule with the ETFs in the table is that you can buy anything because, given time, they should all do well. My feeling is that the best strategy is to have a programme for any ETF you buy so over time you will add to your holdings to capitalise on the £-cost averaging effect. ETFs are ideal for this because, unlike individual shares, they always rebound. Some of the ETFs in areas like robotics, semiconductors, small cap growth and even the S&P 500 are duplicates so there is no need to buy two ETFs doing much the same thing. In general, growth and momentum are different words to describe the same phenomenon. At the end of the day I would describe all the ETFs listed above as momentum investments. If a business doesn’t have momentum there is no point in buying the shares.