Wobbly markets remain treacherous but still hints of better times to come

OGIG stands for O’Shares Global Internet Giants. It is an interesting ETF because it is full of exciting technology shares including the giants and even some Chinese names. It peaked in November and has been falling ever since. There are some signs that it may be building a base. It is higher now than the low point reached in February.

This ETF is one of my indicators. When it gives an unequivocal buy signal I will feel much happier about the outlook for shares. What do I mean by an unequivocal buy signal. I mean that a line connecting the high points of the downtrend has been decisively broke. I mean a golden cross by the moving averages with a rising blue line crossing a rising red line. I mean a change of direction by the Coppock indicator, which is currently falling sharply and has just entered negative territory. This is important because a classic Coppock buy signal is given when the indicator turns higher having previously become negative.

There is another indicator which I am watching closely which is the balance of shares in the QV for Shares table looking bullish versus those looking bearish. This is particularly important because all the shares in the QV table where chosen for their growth (3G) characteristics. The table gives me an important clue to the health of a particular section of the market – high growth shares.

You will not be surprised to learn that the balance is still heavily negative. There are some signs of a bottoming out process but I would not argue with anyone who decided to stand well clear of this market until we had unequivocal signs of improvement with my indicators turning bullish. Needless to say I will keep subscribers posted as things happen.

Another question is why has the market been so weak. I don’t think the war in Ukraine has a great deal to do with it. We have learned that Putin is a ghastly individual presiding over a fragile economy with a large but demoralised army but we knew most of that already. Here’s hoping the Ukrainians give the monster a bloody nose. Maybe El Viejo (Spanish for the ancient one as I think of Joe Biden) is right and he will end up losing power or maybe not. They don’t come much more evil than Maduro in Venezuela and he is still there.

I think there are two main reasons why shares are falling, especially those in high growth businesses. First is that these shares had such an incredible run in the bull market between 2009 and November 2021. Not only were the businesses growing fast but investors became more enthusiastic about companies which invest so heavily in growth that they make persistent losses. The basis of valuation for many exciting shares moved from profits to sales which allowed values to climb sharply. We ended up with shares in loss making businesses on valuations between 20 and 50 times sales or sometimes even higher. This left them vulnerable to a change of sentiment and meant that many shareholders had enormous profits to protect.

A second reason for the sell-off and most likely the trigger has been rising interest rates and the fear of further rises to come as a world beset by shortages battles inflation. A backdrop like this has been difficult for shares in the past and so it is proving yet again.

On a longer term basis the big driver of rising share values and the high growth being delivered by many businesses is the technology revolution. There is no sign that this is ending or even slowing down. There are so many opportunities for companies to invest in exciting innovations like AI, virtual reality, 5G, the metaverse, augmented reality, autonomous driving, space exploration, futuristic factories, renewable energy, the Internet of Things, smart everything and on an on.

I have just bought a new TV which is enormous compared to the ancient model it replaces, has all kinds of capabilities that my old TV didn’t have. You can talk to it for goodness sake. Amazing as this TV is there is a new model coming out in June which will cost 50pc more. What will that one be able to do? The mind boggles.

I realise that although I love technology shares personally I live in the past. My car is 20 years old. I live in 19th century properties. I have never played video games; but I am starting to engage with the new century. We have just bought two new ovens and my daughter is already raving about the capabilities of the new oven. The combination steam and microwave has yet to be installed but I am sure we are going to be stunned by what that can do as well.

I am updating at the instigation of my children. I am not that bothered myself but they are part of the generation which is taking over so I go with the flow.

In stock market terms this period of bloodletting will lay the groundwork for a renewed advance. I don’t expect inflation to become self-feeding as it was in the 1970s but it is the kind of problem that can get worse before it gets better. I have no idea where interest rates will end up but at some point they will stabilise and probably fall which when it happens will be bullish for shares.

In this issue I am looking at shares which are classic 3G and look exciting. There are still some around but at the moment they are like fish trying to swim against the current.

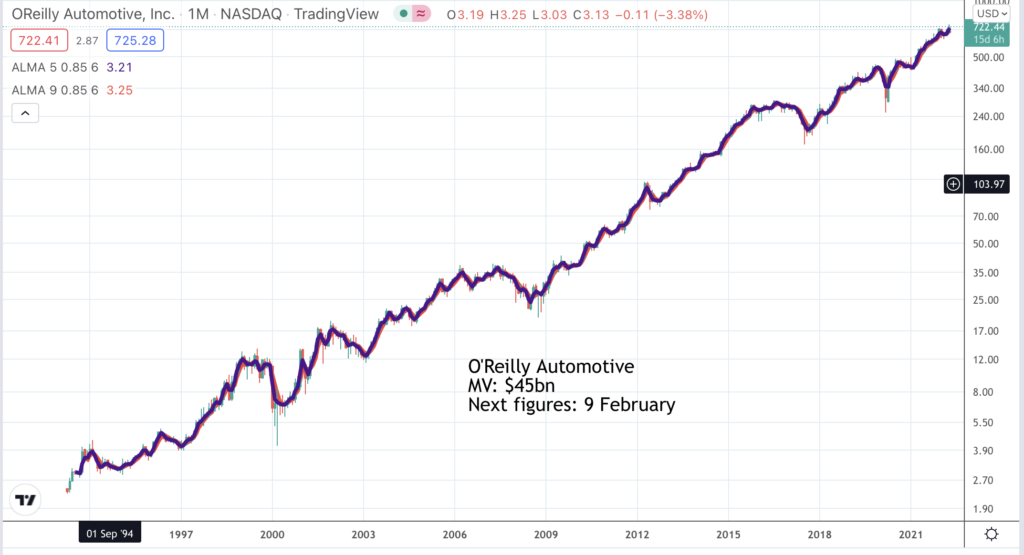

O’Reilly Automotive. ORLY. Buy @ $721.5 – “For 2021, our average store generated sales of $2.3m, which represents an increase of over 23pc from the average store sales volume just 2 years ago in 2019. During this same time — period of time, our operating profit dollars per store has grown by an incredible 42pc as our store and distribution teams leveraged our dual market business model to drive very strong operating profit flow-through.”

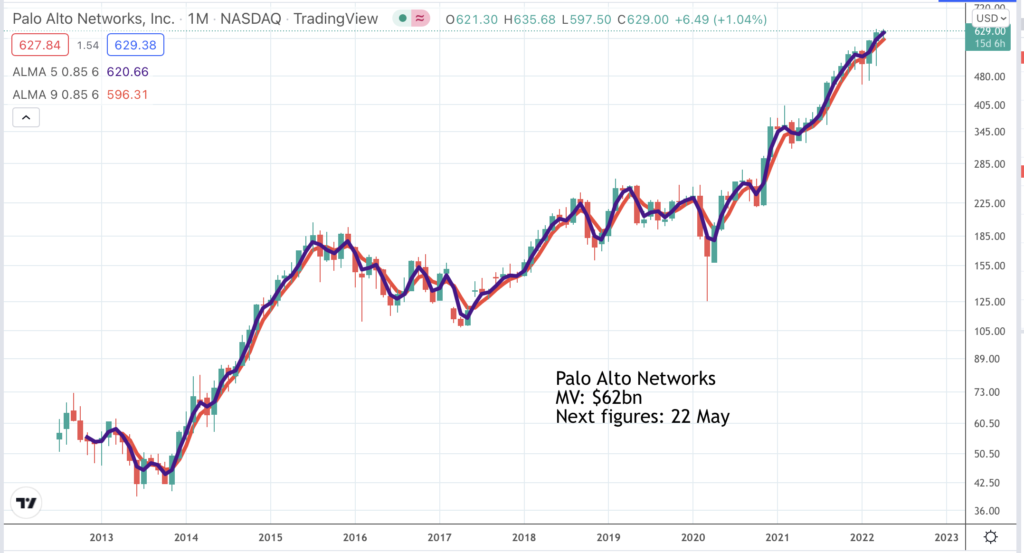

Palo Alto Networks. PANW. Buy @ $612.5 – “Execution from our go-to-market teams means focusing on the broader customer-driven priority of helping them significantly improve their cybersecurity posture. This is demonstrated by the multi-platform large deal commitments we’re beginning to see.”

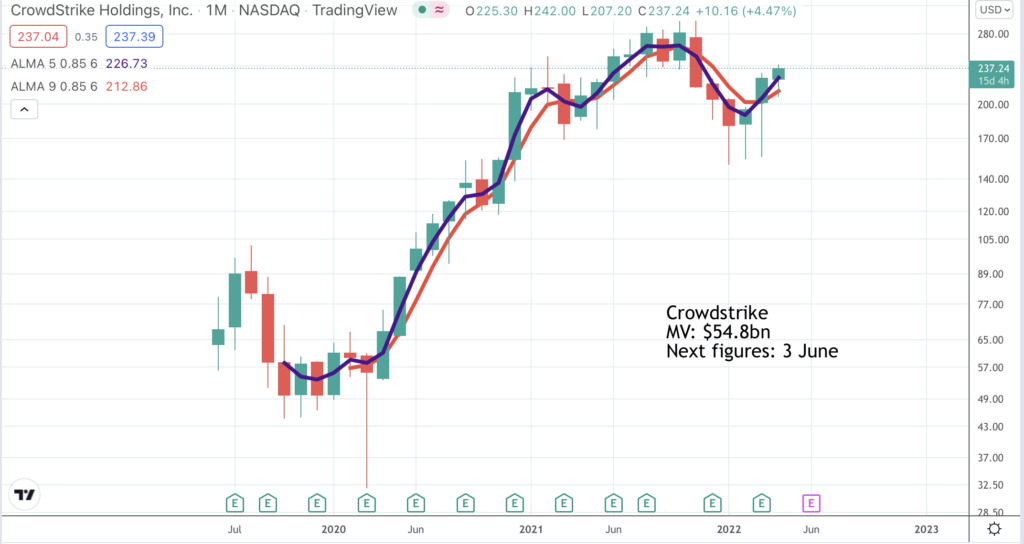

Crowdstrike. CRWD. Buy @ $222.5. “The success of our platform strategy is reflected in the hypergrowth we are deriving from many of our modules, as well as our strong module adoption metrics, which have consistently increased quarter after quarter. In Q4, subscription customers with four or more, five or more and six or more modules increased to 69%, 57% and 34%, respectively. As both new and existing customers increasingly trust Falcon to solve security challenges outside of core endpoint, we have multiple product areas contributing significantly to ARR growth.”

Pepsico. PEP. Buy @ $170.5 – “Our strong topline performance was underpinned by an acceleration across both our global beverage and convenient foods businesses which respectively delivered 11 percent and 13 percent organic revenue growth.”

UnitedHealth Group. UNH. Buy @ $538.5 – “Overall, OptumRx’s performance in the quarter, healthy retention rates, and strong sales pipeline provide a great foundation for growth. These efforts, from expanding in-home and broad-based — broad value-based care offerings, to enhancements to Medicare Advantage, to simplifying how to finance care, are designed to create greater value for consumers and more broadly have a profound impact on the lives of families and individuals and communities with all levels of need across America.”

O’Reilly Automotive. ORLY. Buy @ $721.5. Times recommended: 4. First recommended: $506. Last recommended: $671

O’Reilly Automotive is a wonderful company but it is also the kind of steady as she goes, resilient type of business that attracts buyers in a bear market. The company supplies spare parts for cars and has benefited as Americans keep their cars longer which means more repairs. It also pioneered cannibalisation which meant opening new stores so close to existing stores that it cannibalised some of their business. The company argued that this was a good idea partly because total sales rose but also because it made it difficult for competitors to move in.

O’Reilly is an amazing performer. “Our team’s performance in 2021 was highlighted by our comparable store sales growth of 13.3pc and diluted earnings per share growth of 32pc. This outstanding performance is even more impressive when you consider that our team delivered these results on top of a record-setting year in 2020, when we achieved comparable sales increase of 10.9pc and growth in earnings per share of 32pc.”

The company is confident on prospects.

“To begin, from a macro perspective, we remain very confident about the health of the automotive aftermarket and believe the stable, robust growth trends experienced in our industry are indicative of ongoing core underlying strength. The value proposition for consumers to invest in their existing vehicles remains very strong driven by scarcity of new vehicle supply, high demand for used vehicles, and the quality of engineering and manufacturing of vehicles currently on the road, merits higher mileages. Our industry history has proven that times of economic uncertainty motivate consumers to take more cautious financial outlook and allocate additional share of their wallet to maintain their existing vehicles.”

The company is also very competitive.

“Beyond this positive macroeconomic backdrop, it is also clear to us that our extremely strong sales results are driven by significant share gains, with our outperformance the direct result of significant competitive advantages afforded by the strength of our business model and supply chain.“

The group also sees a major opportunity n the professional market (as opposed to the diy market).

“Against this backdrop, we have been very successful in gaining professional market share and growing substantially faster than the overall market through the strength of our industry-leading inventory availability, tiered distribution and hub network and world-class professional parts people.

However, we believe that the current disruptive environment presents an opportunity for us to enhance our competitive positioning and leverage our competitive advantages to drive accelerated long-term market share gains. Over the course of the past few quarters, we’ve tested several professional pricing strategies in multiple markets.

We’ve been very encouraged by the results of our testing. And after dialing in our strategy, we rolled out the professional pricing initiative company-wide at the beginning of February. For 2022, we expect to see a meaningful benefit to our professional customer comps from share gains, which we’ve incorporated into our comparable sales growth expectations.”

O’Reilly’s market share has roughly doubled from 10 to 20pc since 2012 making the group an ever more formidable competitor.

Palo Alto Networks PANW. Buy @ $612.50. Times recommended: 16 First recommended: $205 Last recommended: $600

In their latest quarterly results published on 22 February the company set out why it believes it is experiencing accelerating growth.

“Firstly, we continue to see strong demand for cybersecurity. We have not seen any changes in the IT spending patterns of our customers or a slowdown in companies investing in IT systems through our competitive advantage. On the contrary, we see acceleration around trends associated with the shift to the cloud as well as the continued efforts to redefine network architectures to enable employees to work effectively from anywhere, a trend which has been bolstered by the pandemic, and we continue to believe we are still in the early innings here.

Both these factors underpin continued demand for cybersecurity services. Secondly, we continue to see an evolving and complicated threat landscape. We’ve highlighted in the past that cybersecurity is at the front and center of all conversations around risks and threats at companies as well as nation-state levels. We believe cybersecurity will continue to become more and more relevant and important.

With increased alliance and technology and the prevalence of cyberattacks, there is an ability to disrupt businesses and critical systems, making cybersecurity an area will — that will need continued focus on investment. In addition to industry-specific trends, we’re seeing a trend that is unique to Palo Alto Networks. Given our investments in the areas and continued relevance across multiple platforms and needs of our customers, we’re having more and more significant partnership conversations, which encompass the entire Palo Alto Networks offering. Whilst early, we believe this is the true differentiation that Palo Alto Networks provides, both best-of-breed and integrated security that works.

Thirdly, our continued focus on execution. This focus is bearing fruit as we execute multiple dimensions across our business. Execution from our product teams means continuing our rapid pace of integrated platform delivery. We will talk about innovation across our platforms.”

Like other successful technology companies Palo Alto Networks is highly innovative.

“At the heart of our three-platform strategy is innovation. This is a fuel of our growth, especially in next-generation security where we play in markets that are early in their life cycle. In the first half of fiscal year 2022, we had 22 major product releases, which is equal to all the releases we had in the full year of fiscal 2020.”

The company is also using the cloud to generate exceptional growth in annual recurring revenue.

“Strong secured demand, innovations we’re bringing to customers such as our Nebula release as well as customer appetite for Gen 4 gives us strong conviction and sustained product demand into fiscal year 2023. Next, I want to spend some time on our NGS business. This is one where our teams have done work, which I personally believe has not been done in the cybersecurity industry before. And this is what makes Palo Alto Network special.

We have built a formidable set of services which are cloud-first, and these services are resonating with our customers. This success is truly driven by us working with our customers to anticipate their challenges, delivering best-of-breed solutions in an integrated fashion while continuing to focus on security outcomes. This has resulted in us building an NGS [next generation security] ARR stream of $1.43bn driven by billings growth of 79pc in NGS. Diving deeper into SASE [secure access service edge], which has been a strong contributor to NGS.

We continue to see strong uptake from our existing customers. We’re also seeing marquee new customer wins, which are reflected in our current customer count of 1,983, which is up 62pc. A recent report from the IT industry analyst Enterprise Strategy Group noted that 78pc of organizations have begun or are planning SASE implementations. We see this mirrored in our customer conversations, where hybrid work is now the way many of these companies are planning on supporting the future work.“

This all adds up to a company which is enjoying tremendous success.

“We developed a unique go-to-market approach, allowing us to promote future modules as part of an integrated offering. We’re seeing tremendous success with this approach. While our active customers grew 21% to 1,810 in Q2, we saw north of 56% growth in credit consumptions driven both by increased adoption of the cloud by our customers and their continued adoption of more security modules in Prisma Cloud. While our two-core modules, cloud security posture management, and cloud workload protection, are mainstream within most of our customer base, we’re seeing an increased adoption of three and more modules.“

Crowdstrike. CRWD. Buy @ $222.5. Times recommended: 21. First recommended: $92. Last recommended: $218.5 Lowest recommended: $51 Highest recommended: $286

“CrowdStrike was founded in 2011 to reinvent security for the cloud era. Realizing that the nature of cybersecurity problems had changed but the solutions had not, we built our CrowdStrike Falcon platform to detect threats and stop breaches. With our Falcon platform, we created the first multi-tenant, cloud native, intelligent security solution capable of protecting workloads across on-premise, virtualized, and cloud-based environments running on a variety of endpoints such as laptops, desktops, servers, virtual machines, and Internet of Things, or IoT, devices. We offer 22 cloud modules on our Falcon platform via a SaaS model that spans multiple large security markets, including corporate endpoint security, cloud security, managed security services, security and IT operations, threat intelligence, identity protection and log management.”

Just looking at that description of what Crowdstrike does makes you think they must be a very exciting company and they are.

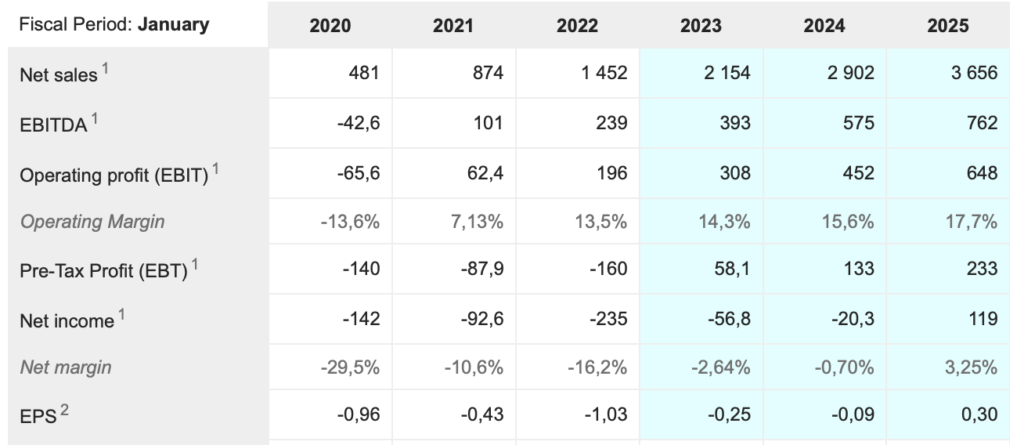

CEO and co-founder, Geogre Kurtz, describes Crowdstrike as ‘A Generational Company’. I have been puzzling about what he means by that – I guess it is American for what we Brits would call a Once in A Generation company. If I am right he is very excited about prospects indeed and it isn’t just hot air. This company is walking the talk. Its performance since launch in 2011 has been spectacular and the recent share price strength reflects the fact that on 7 April the group updated its sales target for the year to 31 January 2026 (effectively 2025) to a staggering $5bn from the already impressive $3.66bn you see in our table below.

If they are confident enough to update their target three years from now so aggressively even that number is going to be beaten. This is a company on fire with huge confidence in what they are doing for their customers. And they are operating in a field of massive demand. Not only is cyber security critical to the successful development of a technology-based world but it is also key when nations are embracing cyber warfare. There are going to be huge budgets for companies like Crowdstrike which can deal with threats at any level.

Other powerful growth drivers for the business are geographical expansion, more modules (which have roughly doubled since 2020) and the opportunity to roll out their products to smaller enterprises. At the moment their share of business with very large concerns (5,000 employees plus) in the US is around 35pc whereas their share with smaller companies and the public sectors is in low single figures. There is a huge amount to go for.

Crowdstrike’s ambitions may seem over the top but the company has been this ambitious from the moment it was founded when it had the stated goal of building the largest private security cloud in the world. It was a reasonable ambition because what they wanted to create didn’t exist. Now it is all happening and guess who is the current market leader, up from number four in calendar 2019 – Crowdstrike.

They also say “CrowdStrike dominates in EDR [endpoint detection & response] while building its future in XDR [extended detection and response security] and Zero Trust.”

Crowdstrike is growing at a phenomenal rate. It reminds me of Microsoft in the early years.

“First, CrowdStrike delivered an exceptional fourth quarter that far exceeded our expectations. This quarter’s results are headlined by an acceleration in net new ARR growth for the second consecutive quarter to reach $217m.

Record 19pc non-GAAP operating margin and record free cash flow of $127m or approximately $197m when excluding the IP transfer tax payment related to the acquisition of Humio. Second, our success outside of traditional endpoint security is now punctuated by both scale and hypergrowth as we surpassed the $150m ARR [annual recurring revenue] milestone, while growing in excess of 100pc year over year for our IT hygiene, vulnerability management, identity protection and log management modules collectively. Third, we exited the year with tremendous momentum for ARR derived from Falcon deployments in the public cloud, where ARR eclipsed the $100m milestone and grew 20pc quarter on quarter as we lead the effort to transform security for the public cloud. And fourth, as you can see from our outstanding results, our growth engine is executing on all cylinders, which includes our thriving partner ecosystem.”

Everywhere you look this company just delivers explosive performance.

“We added over 1,600 subscription customers for the third consecutive quarter, bringing the total number of customers that rely on CrowdStrike to protect their business to 16,325, a 65pc increase year over year. Demand in the quarter was broad-based and new wins included sizable deals with multiple top global financial services organization, a record number of new Falcon Complete customers, including Fortune 500 and multinational companies across the technology, media, telecommunications, education and government sectors, among many others. Record lands for our Cloud Workload Protection module and Horizon, our agentless cloud security posture management module, including wins at a large US insurance provider, a Fortune 250 software company, and a Fortune 50 energy company. We achieved another record quarter for our identity protection modules, which significantly differentiates Falcon in the field and continue to lead to higher win rates.”

Bottom line, Crowdstrike is one of the most exciting companies I have ever encountered.

Pepsico. PEP. Buy @ $170.50. Times recommended: 5. First recommended: $156.49. Last recommended: $175

Pepsico is a good example of a superbly managed US multinational. It makes 55pc of its money from convenient foods and 45pc from beverages with 56pc of sales in the United States and 44pc in the rest of the world. When you are as big as PepsiCo with 2021 sales of $79.5bn there is always great scope to make the business more efficient. This is reflected in the company’s commitment to becoming a ‘Faster, Stronger and Better’ company. It seems to be working. Results for full year 2021 showed organic sales growth of 9.5pc and growth in constant currency earnings per share of 12pc.

In an era of explosively growing technology disruptors 12pc eps growth may not seem that big a deal but keep performing like that year after year and you get a share price excluding dividends reinvested which has risen 310 times since 1975. You also have a business which is very defensive in difficult times. Its products cost little and for most people who consume them are staple parts of their diet.

You can see how much Pepsico is a management story with a quote from the 2021 accounts.

“Introduced in 2021, pep+ (PepsiCo Positive) is the future of our company—a strategic, end-to-end transformation that places sustainability and human capital at the center of how we create growth and value. It recognizes a new business reality, where consumers are becoming more interested in the future of the planet and society.

Winning with pep+ reflects the way we plan to win in the marketplace and position ourselves to deliver top-tier financial performance, whilst continuing to transform ourselves to create value for all of our stakeholders. It embeds pep+ firmly at the center of our business, from how we innovate, to how we operate, to how we run our teams and build our brands.

And it is the key to sustaining the kind of performance we delivered in 2021 — a year that saw us become an even Faster, even Stronger, and even Better company and that was, in some ways, one of the most successful years in PepsiCo’s recent history.

Shareholders do well from companies like Pepsico because of a combined dividend payment and share buyback programme. In 2022 the company expects to return $7.7bn in dividends and share buybacks to share holders v $5.9bn in 2021, which is an increase of 30.5pc and testament to the confidence of management in their strategy.

My impression is that a big factor in why Pepsico is doing so well is the appointment of Ramon Laguarta as chairman and chief executive in October 2018. Growth has accelerated since he took charge and their is a real feeling of renewed purpose at the business.

The company is accelerating its efforts to become more sustainable in products as well as across the supply chain.

“We entered into new business ventures with Beyond Meat to develop, produce and market plant-based protein products, and The Boston Beer Company to target the low- alcohol occasion with our Mountain Dew brand.“

The company looks well placed for solid growth to continue.

“As we look ahead to 2022, we believe our businesses can build on the momentum and strength delivered in 2021. With consumer preferences gravitating towards convenience, variety, and portion control, we believe our categories can continue to perform well and that our product and package varieties are well positioned to capitalize on these trends.”

UnitedHealth Group. UNH. Buy @ $538.5. Times recommended: 11. First recommended: $293. Last recommended: $495

I think of UnitedHealth as America’s answer to the NHS except that it is bigger and dramatically more successful. If you look at the chart you can see that it is hard to stop these shares from climbing. They marked time in the 1990s when investment was all about the build-up to the great Internet bubble and they tumbled in 2008-09 when investors were discounting the collapse of the global banking system and a rerun of the 1930s depression. Apart from that the progress has been extraordinary. Since the 1988 low point the shares have climbed 6,682 times and the total return would be considerably higher since UNH pays dividends. It makes me wonder if this is the best performing share of all time. Even Microsoft cannot match this performance.

I would have to go back in time to really understand why these shares have done so well. At root it seems that the success is because healthcare is a growth area and UNH is not only capitalising on that growth but over the decades has steadily increased its market share. Frankly, when I read about what they do and how well they do it, I wish they would buy the NHS. We would all be healthier and live longer as a result. Americans are not healthier and don’t live longer but that is because of problems not of UNH’s making like obesity (Americans in general are ridiculously overweight though this is less apparent in places like New York) and other things like the opioid crisis.

For such a large business the growth being delivered by UNH is staggering.

“Our first quarter 2022 performance positions us well to deliver on our full year financial and growth objectives. Revenues grew by $10bn or 14pc to $80bn over the year-ago first quarter, with double-digit growth at both Optum and UnitedHealthcare. This strong diversified growth was largely organic with balanced contributions from across both our services and benefits operating platforms.Compared to a year ago, we are adding over 1m more people to OptumHealth, supporting 30pc more patients in value-based relationships, providing over 20m more prescriptions, and serving 1.5m more people across our health benefit offerings.“

The scale of UNH is amazing. At their November 2021 investors’ conference when they set a target of growing over the long term at between 13pc and 16pc they also noted that they had 340,000 employees and 146m customers. Processing nearly $1 trillion in gross billed charges in 2020, UnitedHealth Group is the largest health insurer in the world with a $500bn market cap. The company’s two businesses are Optum and UnitedHealthcare. The former is a technology-driven health services business while the latter offers health insurance to employers, individuals, and governments.

I think of UnitedHealth Group as like a two-stage rocket. The first stage is United Health the insurance arm of the business. The second and arguably more exciting bit is Optum, which is using technology to improver health care for a growing army of people. UHG acquired Optum, a technology business, in 2014 and merged it with its existing subsidiary, GSD (Global Service Delivery).

UnitedHealth sells health benefits which is health insurance. In the USA instead of funding health through the tax system US citizens buy insurance. Growth comes by recruiting more people and by trying to use technology to provide health benefits more affordably. Optum provides health care services like pharmacy to fulfil prescriptions, data and analytics to improve healthcare efficiencies, Another division, “OptumRx provides a full spectrum of pharmacy care services through its network of more than 67,000 retail pharmacies, multiple home delivery, specialty and community health pharmacies and through the provision of in-home and pharmacy infusion services. OptumRx manages limited and ultra-limited distribution drugs in oncology, HIV, pain management and ophthalmology and serves the growing pharmacy needs of people with behavioral health and substance use disorders, particularly Medicare and Medicaid beneficiaries.”

In 2020, OptumRx managed $105bn in pharmaceutical spending, including $46bn in specialty pharmaceutical spending.

UnitedHealth Group Inc., based in Minnetonka, Minn., runs UnitedHealthcare, a health insurance business that covers more than 48m people mostly in the United States. Its Optum segment runs one of the nation’s largest pharmacy benefit management operations as well as a growing number of clinics and urgent care and surgery centers. Optum served 100m people in 2021, up from 98m the previous year. Revenue per consumer in that business increased 33pc. Revenue for all of 2021 rose almost 12pc to $287.6bn, and earnings from operations were $24bn, with the Optum businesses making up more than half of that total.